Fiscal Federalism at the Crossroads:

Punjab–Himachal Car Levy Protest and the Unfinished Agenda of GST-Led National Integration

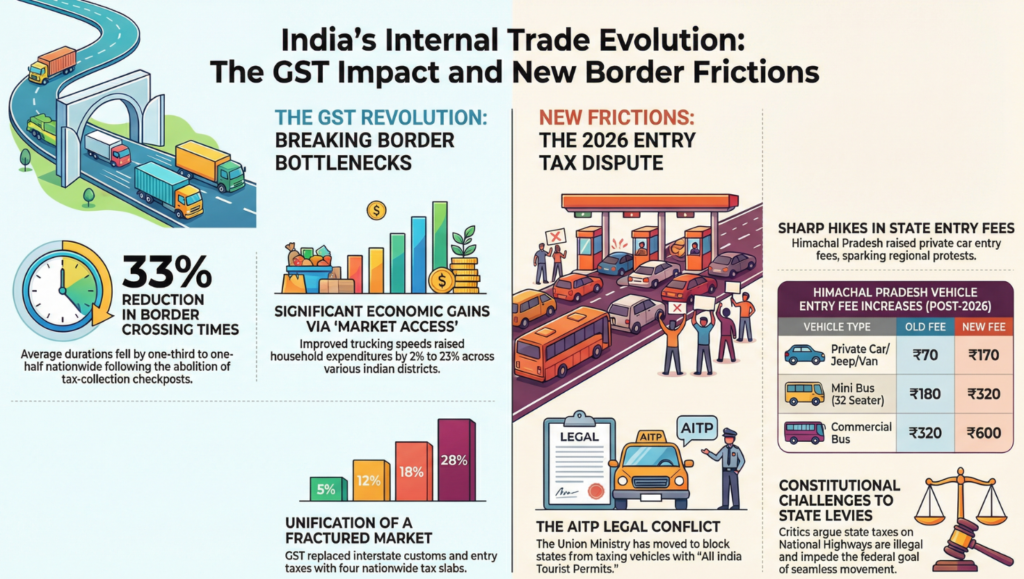

I. Introduction: When a Border Fee Becomes a Federal Flashpoint

The recent Punjab–Himachal border protests against the sharp hike in vehicle entry fees by Himachal Pradesh have reopened a larger national debate:

Are we witnessing a quiet return to the fragmented, pre-GST India?

The levy—raising charges for out-of-state vehicles (e.g., private cars from ₹70 to ₹170)—has triggered protests in border districts of Punjab, where residents depend on daily cross-border mobility for trade, employment, healthcare, and education.

While the issue appears local, it carries profound implications for:

- Fiscal federalism

- Inter-state trade integration

- Centre–State power dynamics

- The legacy of the 2017 GST reform

This episode must be understood not as an isolated protest, but as a stress test of India’s post-2017 economic architecture.

II. The 2017 GST Reform: From Fragmentation to a Unified Market

Goods and Services Tax was not merely a tax reform—it was a logistical revolution disguised as fiscal policy.

Pre-GST India: The Fragmented Market

Before 2017:

- Multiple taxes: CST, VAT, Octroi, Entry Tax

- Border checkposts at every state boundary

- Physical inspections and rent-seeking

- Logistics costs at 14% of goods value

- Estimated GDP loss: ~0.98% due to waiting costs

Truck detention at state borders was described as the “greatest malaise” of the transport sector.

Internal trade barriers in India were estimated to be 5 times higher than the US.

III. Structural Mechanics of GST: How It Dismantled Barriers

GST replaced origin-based taxation with a destination-based consumption model, eliminating the fiscal need to stop goods at state borders.

Three pillars enabled this transformation:

- GST Council – Institutionalized cooperative federalism.

- GST Network (GSTN) – Shifted compliance from roadside to cloud.

- e-Way Bill System (2018) – Digitized goods movement.

Empirical Impact (GPS Evidence from 29,000 Trucks)

- Border crossing times fell by 25–32 minutes nationally.

- Eastern India saw gains up to 3 hours per crossing.

- Household expenditure increased by up to 23% in highly exposed districts.

GST acted as a regional equalizer, integrating the Northeast and Eastern corridors into national supply chains.

IV. The Resurgence of State-Level Frictions: Vertical Fiscal Imbalance

Despite GST integration, states face a persistent Vertical Fiscal Imbalance:

- States handle large expenditure responsibilities.

- Revenue-raising capacity remains constrained.

- Post-compensation period pressures intensify fiscal stress.

The Himachal vehicle entry levy reflects this structural tension.

Why This Matters

Though technically outside GST (since it applies to vehicles entering territory rather than goods), such levies recreate:

- Border friction

- Compliance uncertainty

- Transaction costs

- Psychological barriers to mobility

This mirrors pre-GST logic—reintroducing physical enforcement at borders.

V. Constitutional and Federal Dimensions

The controversy touches multiple constitutional themes:

1. Freedom of Trade and Movement

- Article 19(1)(d): Freedom of movement.

- Article 301: Freedom of trade, commerce and intercourse.

2. National Highways Question

If levies apply at entry points connected to Union-funded National Highways, it raises questions of federal overreach.

3. Cooperative Federalism vs Competitive Federalism

GST sought harmonization through the GST Council.

Entry levies risk fragmenting that harmonized architecture.

VI. Border Communities: The Human Cost

The most immediate impact is not macroeconomic—but local.

Affected groups include:

- Daily commuters

- Students

- Patients accessing hospitals

- Small traders

- Tourism operators

For many border residents, state boundaries are administrative—not economic realities.

The protest slogan captures the sentiment:

“Borders may exist on maps, but not in our lives.”

VII. The Policy Risk: A Slippery Slope Back to Checkpost India?

If states increasingly resort to:

- Entry fees

- Tourist levies

- Transport surcharges

- Checkpost-based enforcement

India risks a gradual erosion of its unified internal market.

The National Informatics Centre (NIC) has already intervened in other contexts to block unauthorized checkpost modules on the Parivahan portal for All India Tourist Permit vehicles—showing that the Centre recognizes the threat.

The larger danger lies not in one levy—but in normalizing fiscal gatekeeping.

VIII. Strategic Recommendations: The “Second Wave” of Integration

To preserve GST’s gains, India needs a second generation of reforms.

1. Federal Guardrails

Clear prohibition on state-level levies at Union-funded National Highways.

2. Border Resident Exemption Framework

Digital passes for daily commuters within 5–10 km border radius.

3. Expand e-Way Bill Logic

Integrate RTO, Forest, and Transport Department checks into digital enforcement.

4. Strengthen GST Council Mandate

Broaden discussions to include non-GST fiscal measures that affect interstate trade.

5. Address Vertical Fiscal Imbalance

Enhance predictable revenue devolution to reduce states’ incentive for ad-hoc levies.

IX. UPSC Relevance

GS-II (Polity & Governance)

- Fiscal federalism

- Centre–State relations

- GST Council

- Article 301 and trade freedom

GS-III (Economy)

- Logistics efficiency

- Internal trade barriers

- Market access multiplier

- Vertical fiscal imbalance

Essay Themes

- “Cooperative Federalism: Promise and Paradox”

- “Logistics as Infrastructure: The Hidden Engine of Growth”

- “When States Tax Borders: The Limits of Fiscal Autonomy”

X. Conclusion: Integration is a Continuous Process

The 2017 GST reform marked a historic shift from fragmentation to integration.

But integration is not self-sustaining.

The Punjab–Himachal protest reminds us that:

- Fiscal pressures can revive border frictions.

- State autonomy must coexist with national unity.

- Logistical efficiency is foundational to economic competitiveness.

India’s challenge is to protect the gains of GST while respecting the fiscal needs of states.

The question is not whether states have the power to levy—but whether such power strengthens or weakens the Union’s economic architecture.

A unified market is not merely an economic objective—it is a constitutional commitment.