🚀 Startup India Fund of Funds 2.0: Strategic Deep-Tech Pivot for Viksit Bharat

Syllabus: UPSC (GS III – Economy | Startups | Innovation | Industrial Policy)

🧭 Introduction: From Ecosystem Seeding to Strategic Scaling

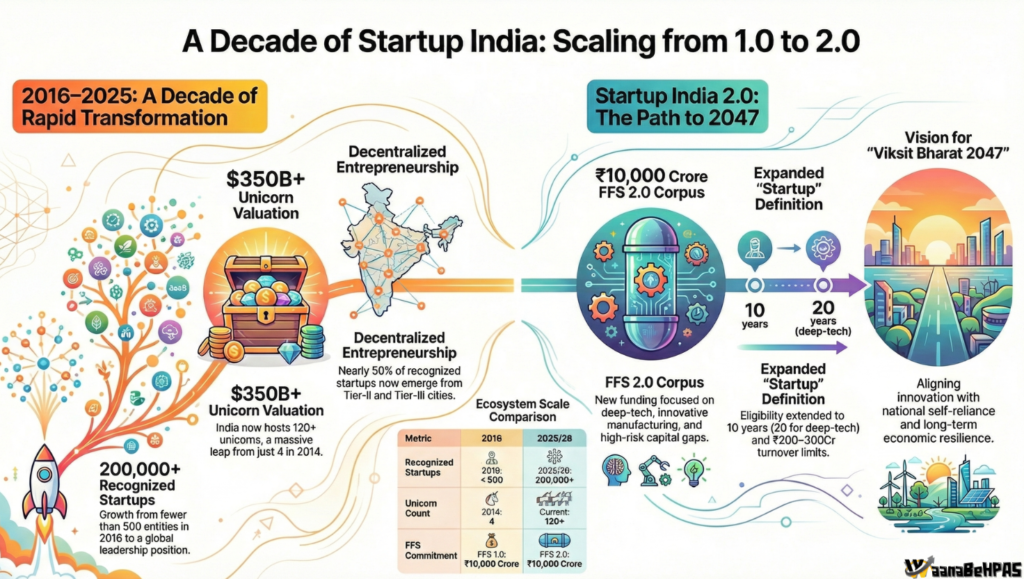

The approval of ₹10,000 crore Startup India Fund of Funds (FFS) 2.0 marks a decisive shift in India’s innovation policy—from quantity-driven startup expansion to strategic industrial scaling. While the 2016 phase catalysed venture capital and expanded the startup base, FFS 2.0 focuses on deep-tech, advanced manufacturing, and sovereign technological capabilities, aligning entrepreneurship with national missions.

Core Shift:

- From consumer-tech growth → to breakthrough R&D and high-entry-barrier sectors

- From foreign VC dependence → to mobilising domestic patient capital

- From metro concentration → to pan-India innovation deepening

1️⃣ A Decade of Transformation: FFS 1.0 to FFS 2.0

| Dimension | FFS 1.0 (2016) | FFS 2.0 (2026) |

|---|---|---|

| Corpus | ₹10,000 crore | ₹10,000 crore (new tranche) |

| Mandate | Bridge funding gaps; build VC ecosystem | Strategic deep-tech scaling |

| Sector Focus | Fintech, e-commerce, services | Deep-tech, quantum, semiconductors, manufacturing |

| Geography | Tier-I cities | Tier-II/III and rural districts |

| Philosophy | Catalytic capital | Patient, strategic capital |

Performance of FFS 1.0

- ₹10,000 crore committed to 145 AIFs

- Mobilised ₹25,500+ crore

- Funded 1,370+ startups

- Built foundational VC market depth

However, India risked a “middle-income innovation trap”, where capital flowed to low-barrier services rather than frontier R&D. FFS 2.0 is designed to correct this structural imbalance.

2️⃣ Strategic Priorities of FFS 2.0

🔹 1. Deep-Tech & Innovative Manufacturing

- Focus on robotics, biotech, AI, quantum, advanced materials

- Aligns with Semiconductor, IndiaAI, and Quantum Missions

- Encourages high-barrier, defensible technologies

🔹 2. Early-Growth Stage Safety Net

- Addresses the “valley of death” between prototype and scale

- Prevents promising startups from collapsing due to funding gaps

🔹 3. National Reach

- Incentivises capital deployment beyond Bengaluru, Mumbai, Delhi

- Leverages valuation arbitrage in Tier-II/III cities

- Aligns with GENESIS programme (1,600 non-metro startups)

🔹 4. Domestic Risk Capital Mobilisation

- Reduces vulnerability to global funding winters

- Encourages pension and insurance funds to invest in AIFs

- Acts as a counter-cyclical stabiliser

3️⃣ Mechanism: How the Fund Works

FFS 2.0 does not directly invest in startups. Instead, it:

- Invests in SEBI-registered Alternative Investment Funds (AIFs)

- AIFs then deploy capital into startups

- Government acts as anchor investor, crowding in private LPs

Why This Model Works

- Maintains market discipline

- Reduces direct fiscal risk

- Leverages professional fund management expertise

4️⃣ Deep-Tech Redefinition: A Structural Game Changer

The 2026 DPIIT redefinition of startups acknowledges longer gestation for deep-tech.

| Category | Eligibility | Turnover Cap |

|---|---|---|

| Standard Startup | Up to 10 years | ₹200 crore |

| Deep-Tech Startup | Up to 20 years | ₹300 crore |

Implications

- Provides longer exit horizon

- Encourages R&D-intensive innovation

- Improves risk-reward balance for AIF managers

This regulatory flexibility supports long-term capital deployment into science-driven enterprises.

5️⃣ Addressing Structural Challenges

Despite growth, India faces innovation bottlenecks:

| Challenge | Risk | Mitigation via FFS 2.0 |

|---|---|---|

| Low R&D (0.64% GDP) | Higher technical failure | Patient capital, higher govt contribution |

| Infrastructure gaps | High logistics cost | GENESIS & mission-mode support |

| Weak exit ecosystem | Lower valuations | Strengthened secondary markets |

| Foreign capital volatility | Funding winter | Domestic institutional capital mobilisation |

FFS 2.0 acts as a strategic hedge against macroeconomic volatility.

6️⃣ Institutional Ecosystem & Digital Infrastructure

FFS 2.0 is embedded within a broader innovation architecture:

- MAARG Portal – Mentorship platform

- BHASKAR – Ecosystem collaboration tool

- Startup India Investor Connect Portal – Digital deal-flow bridge

Regulatory Reform Alignment

- Capital gains & GST parity for AIFs

- Harmonised pricing norms (SEBI–FEMA–IT Act)

- Listing of AIFs for permanent capital

These measures aim to prevent fund management offshoring and deepen India’s domestic capital markets.

7️⃣ Macroeconomic Significance

FFS 2.0 supports India’s ambition of becoming a $7.3 trillion economy by 2030 and achieving Viksit Bharat 2047.

Expected Outcomes

- Strengthened supply-chain resilience

- Indigenous semiconductor & advanced manufacturing ecosystem

- Higher skilled employment

- Enhanced export competitiveness

- Reduced strategic dependence

It marks the shift from digital mediation to physical and frontier innovation.

8️⃣ Critical Evaluation (UPSC Perspective)

Strengths

- Catalytic capital with multiplier effect

- Aligns industrial policy with innovation financing

- Encourages long-term domestic capital

Concerns

- Risk of misallocation without strict governance

- Potential crowding out if state dominance increases

- Need for parallel reforms in IP, labour, logistics, and research funding

📝 Conclusion: From Startup Nation to Innovation Power

Startup India Fund of Funds 2.0 is more than a funding mechanism—it is a strategic industrial policy instrument. By prioritising deep-tech, patient capital, and domestic risk mobilisation, it aims to anchor sovereign technological capability and move India up the global value chain.

The success of FFS 2.0 will depend on transparent governance, ecosystem reforms, and effective AIF management. If implemented efficiently, it can transform India from a startup hub into a globally competitive innovation power.

📚 UPSC Quick Revision Box

🔹 Prelims Focus

- Corpus: ₹10,000 crore

- Model: Indirect investment via SEBI-registered AIFs

- Deep-Tech Startup eligibility: 20 years, ₹300 crore turnover cap

🔹 Mains Keywords

- Patient Capital

- Valley of Death

- Domestic Risk Mobilisation

- Industrial Scaling

- Innovation-led Growth

- Counter-cyclical Stabiliser

🔹 Possible Mains Questions

- “Examine the significance of Startup India Fund of Funds 2.0 in strengthening India’s deep-tech ecosystem.”

- “Discuss how venture capital policy can support India’s transition to an innovation-driven economy.”

- “Critically analyse the role of patient capital in achieving Viksit Bharat 2047.”