Consumer Price Index (CPI): Definition, Types, Calculation & Importance | UPSC Notes

Syllabus: Indian Economy (UPSC GS III)

What is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) measures the average change in the prices of a basket of goods and services consumed by households over time. It reflects inflation, cost of living, and changes in purchasing power.

It tracks price movements of items such as food, fuel, clothing, housing, education, transport, and healthcare.

CPI is one of the most important indicators used by the RBI, government, businesses, and households for economic decision-making.

Why Do We Need the Consumer Price Index (CPI)?

CPI acts as the primary measure of retail inflation in India and serves several key purposes:

1. Inflation Measurement

- CPI is India’s headline inflation indicator.

- RBI uses CPI-Combined (CPI-C) for monetary policy under the inflation-targeting framework.

2. Policy Formulation

- Helps government plan fiscal policy, subsidies, welfare schemes.

- Guides RBI in adjusting repo rates to control inflation.

3. Indexation

CPI is used to revise:

- wages

- pensions

- dearness allowance (DA)

- social security payments

4. Budgeting & Economic Planning

Helps estimate:

- changes in real income

- cost of government programmes

- impact of inflation on vulnerable groups

A reliable CPI supports overall economic stability and long-term growth.

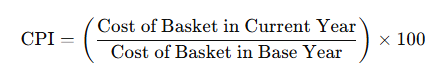

How is CPI Calculated?

CPI measures the price change of a fixed basket of goods and services by comparing the current cost with the base-year cost.

Formula:

Base Year:

Currently 2012 (MoSPI plans to revise it).

Types of Consumer Price Index (CPI) in India

India releases multiple CPI indices catering to different population groups:

1. CPI for Industrial Workers (CPI-IW)

- Compiled by Labour Bureau

- Covers workers in factories, mines, railways, ports, electricity etc.

- Used for DA revision for government and PSU employees.

2. CPI for Agricultural Labourers (CPI-AL)

- Measures price changes faced by agricultural labourers

- Used for rural wage revision

3. CPI for Rural Labourers (CPI-RL)

- Similar to CPI-AL but covers broader rural groups

4. CPI-Combined (CPI-C)

- Released by NSO/MoSPI

- Represents national inflation (rural + urban)

- Used by RBI for monetary policy

CPI vs WPI (Wholesale Price Index)

| Feature | CPI | WPI |

|---|---|---|

| Measures | Retail inflation (household level) | Wholesale price inflation |

| Includes Services | Yes | No |

| Published by | NSO (MoSPI) & Labour Bureau | Office of Economic Adviser (DPIIT) |

| Policy Use | RBI uses CPI-C for inflation targeting | No longer used for monetary policy |

Importance of CPI in India

1. Guiding Monetary Policy

RBI uses CPI-C to decide repo rate:

- High CPI → raise interest rates

- Low CPI → reduce rates

2. Evaluating Purchasing Power

Helps understand how inflation affects household consumption and real income.

3. Economic Planning

CPI data supports formulation of:

- welfare schemes

- food security programmes

- DBT adjustments

4. Wage & Pension Indexation

Used to calculate:

- DA for government employees

- pension adjustments

- labour wage revisions

Key Takeaways for UPSC Aspirants

- CPI measures price changes of a basket of goods/services at consumer level.

- CPI includes both goods and services, unlike WPI.

- Base year for CPI: 2012.

- RBI uses CPI-Combined for inflation-targeting.

- CPI-IW is used for DA revision.

- CPI helps set monetary policy, welfare programmes, and budget planning.