India–EU Trade Pact: The “Mother of All Trade Deals”

Syllabus: UPSC GS-III (Indian Economy & trade)

Geoeconomic Strategy, Sectoral Gains and Negotiation Red Lines

Introduction

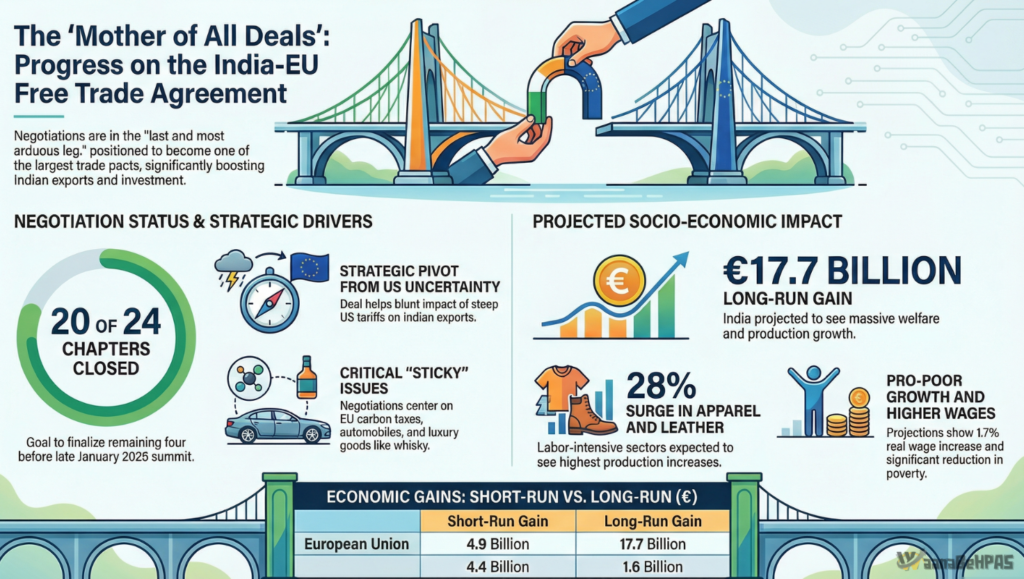

The proposed India–European Union Free Trade Agreement (FTA) is being described by Commerce Minister Piyush Goyal as the “mother of all trade deals.” This is not routine trade diplomacy—it is a strategic reset of India’s external economic engagement at a time when global trade is turning protectionist and uncertain.

With 20 of 24 chapters already closed (January 2026) and the 16th India–EU Summit scheduled for 27 January, the agreement could become India’s most comprehensive pact with a developed bloc, surpassing deals with UAE, Australia and others. It combines:

- market access

- investment flows

- standards & sustainability

- supply-chain integration.

1. Strategic Imperative – Beyond the US-Centric Model

A. Multi-Alignment in a Protectionist World

Global trade is fragmenting. Rising tariffs and policy unpredictability in major markets have forced India to diversify economic partnerships. The EU deal is therefore:

- a hedge against US market volatility

- a route to regain lost export orders (apparel sector alone lost ~$2 billion)

- a pathway to embed India in trusted value chains.

B. Why the EU Matters

- 27-nation, high-income market

- strong demand for Indian:

- textiles & leather

- engineering goods

- pharmaceuticals

- IT & business services

- EU standards shape global norms—entry here upgrades Indian industry.

C. Negotiation Velocity

- 20/24 chapters concluded

- daily technical engagement

- political momentum around the January summit.

UPSC Insight: FTAs today = economics + geopolitics + standards diplomacy.

2. Economic Architecture – Sectoral Differentiators

The pact is not a simple tariff swap; it is an attempt to integrate India into high-value supply chains while protecting domestic stability.

A. Labour-Intensive Export Boost

- Wearing apparel & leather expected ~28% output rise

- Crucial for employment and reversing market loss to Vietnam/Bangladesh.

B. Automotive & Industrial Balance

- EU seeks access for automobiles

- India must safeguard:

- domestic manufacturing

- employment

- industrial sovereignty.

C. Services & FDI Liberalisation

Current FDI restrictions raise trade costs:

| Sector | Extra Trade Cost |

|---|---|

| Transport Services | 18.6% |

| Other Business Services | 18.6% |

| Insurance | 18.1% |

Reforms in:

- insurance equity limits

- business services

- mobility of professionals

are key to welfare gains.

D. Non-Tariff Barriers (NTBs)

Real access depends on:

- standards recognition

- certification

- conformity procedures.

Infographic

3. The “Red Lines” of Negotiation

A. Agriculture – Strategic Exclusion

- Politically sensitive in both India & EU

- Kept largely off the table to avoid:

- GM product disputes

- farmer protests

- French agricultural resistance.

B. Carbon Border Adjustment Mechanism (CBAM)

Biggest technical hurdle for:

- steel

- aluminium

- MSME exporters.

India’s proposal:

→ “Carbon Equalisation Duty” so revenue stays in India, not at EU border.

C. Whisky–Auto Nexus

Balancing:

- EU demand for lower duties

- India’s industrial concerns

requires calibrated phasing.

4. Sustainability & Social Impact

A. Pro-Poor Outcomes

Trade Sustainability Impact Assessment projects:

- 1.7% rise in real wages (skilled & unskilled)

- reduction in urban & rural poverty.

B. Labour Transition

- 1,830–2,650 workers/100,000 may shift sectors

- considered positive pull toward higher productivity jobs.

C. Environment

- Short-term emission rise in textiles/autos

- offset by:

- EU green technology transfer

- cleaner production norms.

5. Opportunities for India

Economic (GS-3)

- export expansion

- EU investment in:

- clean tech

- electronics

- advanced manufacturing

- MSME upgradation.

Strategic (GS-2)

- stronger India–EU partnership

- rule-shaping power

- supply-chain resilience.

6. What India Must Secure – Critical Success Factors

- Regulatory Approximation – frictionless entry to 27 markets

- SPS Support for SMEs – labs, testing, certification

- Trade Adjustment Package – for vulnerable sectors

- Rules of Origin safeguards

- Carbon Sovereignty via Equalisation Duty

- Skill & standards upgrade mission.

UPSC VALUE ADD

Syllabus Links

GS-2: India–EU relations, economic diplomacy

GS-3: trade, MSMEs, inclusive growth, sustainability

Essay: globalization vs protectionism

Probable Mains Questions

- “The India–EU FTA is a geostrategic instrument as much as a trade pact.” Discuss.

- Examine opportunities and challenges for India in the proposed India–EU trade agreement with special reference to CBAM and MSMEs.

- How can India balance market access with agricultural and environmental sensitivities in mega FTAs?

10 Prelims Facts

- 20 of 24 chapters closed (2026).

- EU = 27-nation bloc.

- CBAM affects metals exports.

- Apparel & leather projected +28%.

- FDI barriers raise services cost ~18%.

- NTBs often bigger than tariffs.

- Rules of Origin prevent rerouting.

- TSIA forecasts 1.7% wage rise.

- Summit on 27 Jan 2026.

- EU standards = global benchmarks.

Conclusion

The India–EU FTA is a defining milestone in India’s economic diplomacy. It signals that New Delhi can negotiate high-standard, value-chain-centric agreements even in a fragmented world. As Ambassador Manjeev Singh Puri noted:

“Trade and flag are two sides of the same coin.”

This pact will project India’s power, protect its sovereignty and anchor its rise as a global economic pole.